Feie Calculator - An Overview

Table of ContentsFeie Calculator for BeginnersThe Single Strategy To Use For Feie CalculatorThe Single Strategy To Use For Feie CalculatorThe Facts About Feie Calculator RevealedSome Known Facts About Feie Calculator.

He offered his U.S. home to develop his intent to live abroad completely and used for a Mexican residency visa with his wife to aid accomplish the Bona Fide Residency Test. Additionally, Neil secured a lasting property lease in Mexico, with strategies to at some point purchase a home. "I presently have a six-month lease on a residence in Mexico that I can extend one more six months, with the intent to buy a home down there." Nonetheless, Neil mentions that getting building abroad can be testing without very first experiencing the place."It's something that people require to be truly attentive about," he claims, and recommends deportees to be careful of usual mistakes, such as overstaying in the United state

Neil is careful to stress to Stress and anxiety tax authorities that "I'm not conducting any carrying out in Company. The United state is one of the few nations that taxes its people regardless of where they live, indicating that even if a deportee has no earnings from United state

tax return. "The Foreign Tax obligation Credit score enables individuals functioning in high-tax nations like the UK to offset their United state tax obligation responsibility by the quantity they have actually currently paid in taxes abroad," states Lewis.

The 10-Minute Rule for Feie Calculator

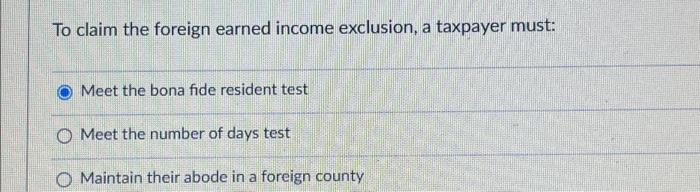

Below are some of one of the most frequently asked questions regarding the FEIE and other exclusions The Foreign Earned Income Exclusion (FEIE) enables united state taxpayers to exclude as much as $130,000 of foreign-earned earnings from federal earnings tax obligation, minimizing their united state tax obligation responsibility. To receive FEIE, you should satisfy either the Physical Presence Examination (330 days abroad) or the Authentic Home Examination (prove your primary residence in a foreign country for an entire tax obligation year).

The Physical Visibility Examination needs you to be outside the united state for 330 days within a 12-month period. The Physical Presence Test additionally calls for united state taxpayers to have both an international revenue and an international tax home. A tax home is defined as your prime location for business or find out here now employment, no matter your family's residence.

Feie Calculator for Dummies

An earnings tax treaty between the united state and another nation can help avoid dual taxation. While the Foreign Earned Revenue Exclusion minimizes taxed revenue, a treaty may give fringe benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Record) is a required declare united state people with over $10,000 in foreign economic accounts.

Eligibility for FEIE relies on conference particular residency or physical visibility examinations. is a tax expert on the Harness system and the founder of Chessis Tax. He is a participant of the National Association of Enrolled Professionals, the Texas Society of Enrolled Representatives, and the Texas Culture of CPAs. He brings over a years of experience benefiting Large 4 firms, suggesting migrants and high-net-worth people.

Neil Johnson, CPA, is a tax obligation expert on the Harness platform and the creator of The Tax obligation Guy. He has over thirty years of experience and currently concentrates on CFO services, equity settlement, copyright tax, marijuana taxes and separation associated tax/financial preparation issues. He is an expat based in Mexico - https://www.edocr.com/v/baoqoy8v/feiecalcu/feie-calculator.

The international made revenue exclusions, sometimes referred to as the Sec. 911 exclusions, leave out tax on incomes made from functioning abroad.

Top Guidelines Of Feie Calculator

The revenue exclusion is now indexed for rising cost of living. The optimal annual income exclusion is $130,000 for 2025. The tax benefit omits the revenue from tax obligation at lower tax obligation prices. Previously, the exemptions "came off the top" reducing earnings subject to tax on top tax obligation prices. The exclusions may or may not minimize earnings made use of for various other purposes, such as individual retirement account restrictions, youngster credit scores, individual exceptions, and so on.

These exclusions do not exempt the wages from United States taxes however simply offer a tax obligation reduction. Keep in mind that a bachelor functioning abroad for all of 2025 that gained about $145,000 without any other earnings will have taxed earnings decreased to no - properly the same answer as being "free of tax." The exclusions are calculated every day.

Comments on “All About Feie Calculator”